Author: Nicole Brown

April 7, 2022 – 8 min read

CBD & The Post-COVID World

“It was the best of times, it was the worst of times…” The COVID-19 pandemic will be remembered as one of the darkest periods in our humanities history, but for cannabinoids, it may go down as its breakthrough moment, the ushering in of the golden age of CBD. Consumers made CBD a popular ingredient over the last two years as a potential remedy for the stress and anxiety induced by the COVID environment. COVID-19 has been a global game-changer on both the collective and individual level: daily routines, work environments, and health habits have been completely turned upside-down and transformed. The perpetual stress, immobility, and sense of uncertainty has taken a toll on consumers’ physical and mental well-being.

As a result of these challenges experienced, many consumers took their health and wellbeing into their own hands. There is both a new wave of consumers and a renewed interest of health-conscious consumers who are looking for transformative health products in the post-COVID environment. In the post-COVID world, there is an enormous opportunity for cannabinoids such as CBD to support consumer health, demonstrating again the power contained in this powerful botanical.

CBD During The Pandemic

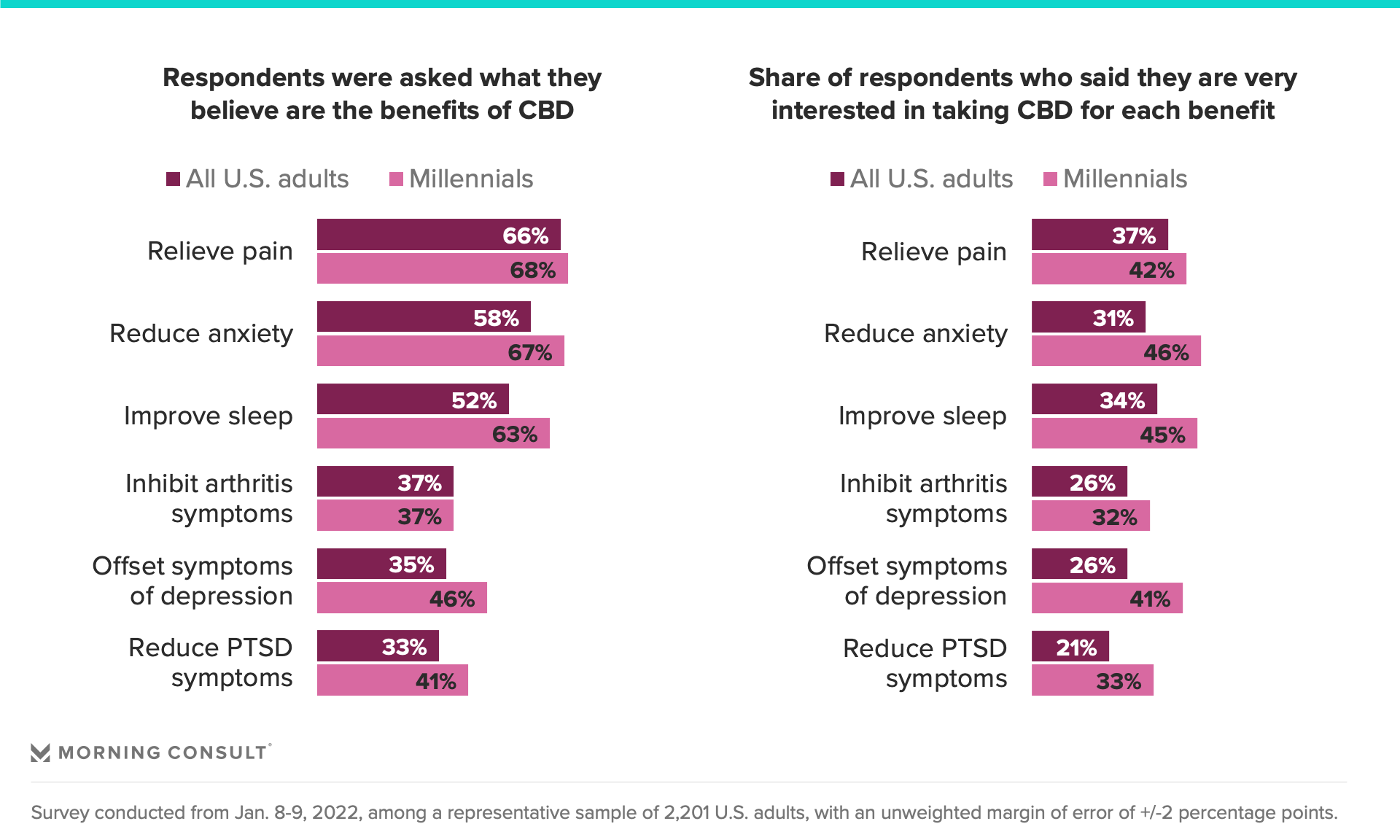

The health benefit most associated with CBD is pain relief. But millennials — the generation credited with normalizing discourse about mental health — are especially attracted to CBD for its mental wellness benefits, including reducing anxiety, improving sleep, and offsetting symptoms of depression, which nearly half believe it can help with.

According to the recent State of Food and Beverage Report from Morning Consult, the pandemic has put mental health in the spotlight: 61 percent of millennials and 52 percent of U.S. adults said in January 2022 that “anxious” described their mood well, while a roughly equal share of U.S. adults said the same in January 2021. With Gen Z taking up the mantle in continuing mental health conversations, CBD (and likely THC) usage should continue to grow.

The growing use of CBD is a telling indicator of consumer mindsets in 2022. In these tense times, consumers are in search of products that can facilitate their mental health goals. Even food & beverage brands that aren’t interested in including CBD in their portfolios can pursue these benefits through alternative products.

Increased usage of CBD may also pave the way for THC-infused products in the food & beverage world, pending federal legality. Interest in THC products is just as high as it is for CBD products, and consumers are especially interested in food and beverage delivery methods. Further research and consumer education will help brands develop products containing CBD or THC targeted for specific uses, giving consumers more confidence in their safety and efficacy.

Passing the Stress Test

Of course, those projections may warrant recalculation should the stress levels that sent so many to CBD in the first place subside. But Dale Baker, President of The Valens Company, wagers we’re in no danger of experiencing any mass-relaxation event just yet.

“Are we really seeing lower stress levels?” he asks. “We all went through a time of unusual stress and uncertainty, and a non-intoxicating, plant-based tool for managing that stress was the right product at the right time. CBD sales are still strong emerging from the pandemic, and to speak from our perspective, we’ve not seen any dampening of demand.”

Cannabinoid market-research firm BDSA also acknowledges stress’s continuing influence on sales, noting that BDSA research shows 33% of CBD consumers cited anxiety management as their key consumption driver, while 32% cited stress management.

Sales Still Strong

The analysts at cannabinoid market-research firm BDSA have as granular a view as any on CBD’s momentum, and as far as they can tell, “CBD sales took a backseat to other essential purchases when the COVID-19 pandemic grew more urgent during the past year,” says Kelly Nielsen, BDSA’s vice president of insights and analytics. But even while in the backseat, domestic CBD sales grew 52% across channels in 2020, BDSA’s analysis reveals, with total sales tipping just over $4 billion for the year. The firm’s projections for 2021 estimate growth of 55%, as well, potentially raising the sector’s take to almost $6.3 billion.

As for where 2020’s sales occurred, the dispensary channel captured the lion’s share, by BDSA’s reckoning, and ultimately accounted for roughly 33% of the category total. But with 25% of the year’s CBD sales, e-commerce wasn’t far behind. In fact, BDSA predicts that if FDA regulations loosen, dispensary sales may shrink as mainstream distribution of CBD products grows. At the same time, though, e-commerce platforms look set to keep their sales on an upward path; BDSA even foresees the e-commerce channel adding $4.1 billion to the category’s till by 2026.

1 in 3 U.S. Adults, And Half Of Millennials, Have Tried A CBD Product

Before the pandemic, CBD went from a secret compound enjoyed by elites to a nearly unavoidable presence in retail stores across the country. Part of the chemical’s appeal lies in its universal applications: infused sparkling waters, chocolates, bath bombs, and, of course, gummies.

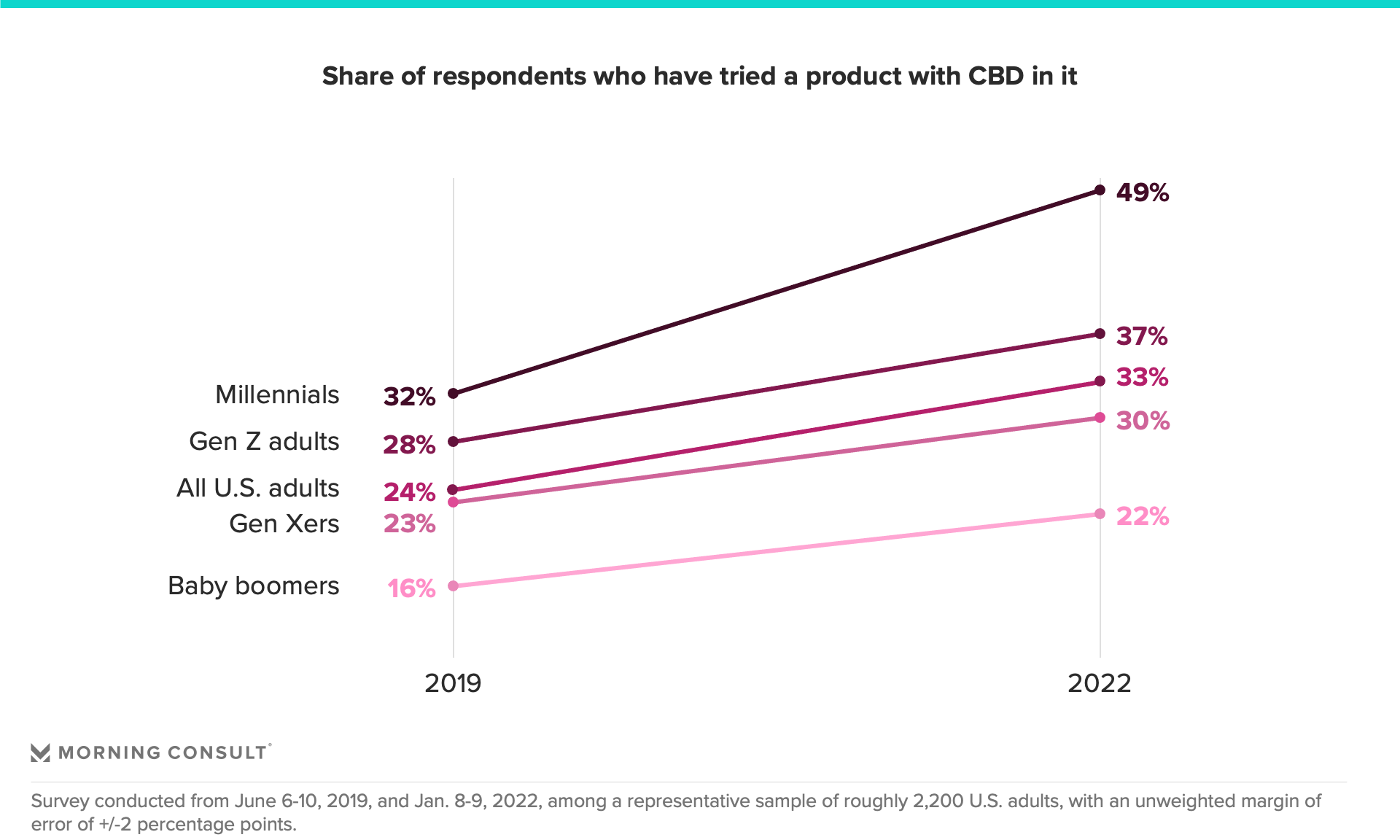

CBD’s ubiquity has led to an increase in awareness among U.S. adults, rising 5 percentage points since June 2019 to 65 percent. Usage, meanwhile, increased from around 1 in 4 to 1 in 3 over that same time period, with the share of respondents who have tried CBD products rising across every generation.

Perceptions of legality may play a role in the increasing usage: 73 percent of consumers now say CBD is legal, versus 61 percent in 2019. But a larger factor is likely the pandemic. This usage increase coincides with a period of heightened stress and anxiety stemming from both the pandemic and its economic toll. Amid the ongoing health crisis, consumers are looking for healthy methods to manage their physical, emotional, and mental well-being.

Evolving Need States

As the CBD category has diversified, so, too, has its typical shopper. And with that evolution, we’ve also seen an evolving set of need states among the consumer base.

For instance, while consumers who have been with the category for at least two years often gravitate toward products to “relax/be mellow” or “improve my quality of life,” those who have entered the market within the past month more often look for targeted benefits, like “relief of menopausal symptoms,” “post-workout recovery,” and “improved libido.”

This phenomenon emphasizes how new CBD consumers “like to shop by solution.” As one example, CBD product manufacturer Green Roads—which The Valens Company purchased in June 2021 — has a feature on its website recommending items “based on whether the consumer is trying to relax, sleep better, or keep their bodies moving for workouts or an active lifestyle,” Baker says.

All of which speak to the role that wellness plays in CBD’s success. Wellness products—topical creams, balms, salves, etc.—as well as pharmaceuticals and supplements, will be the three biggest categories driving CBD sales in the coming years, and wellness alone is expected to contribute $2.9 billion to the growth of the U.S. CBD sales by 2026.

Health-and-wellness consumers are looking for functional ingredients in all their lifestyle purchases, and the data show that consumers are willing to take advantage of CBD’s benefits in everyday products, rather than in standard medicinal products.

Food for Thought

Also driving sales are edible applications. BDSA ranks edibles the most popular CBD delivery format, with 75% of consumers who’ve partaken of the cannabinoid in the past six months reporting to have chosen an edible. IRI data also indicated growth of more than 23% in the food channel.

SPINS data paint a similar picture, with CBD-infused beverages looking especially bright. Shelf-stable coffee sales were up 111% through June 13, while shelf-stable waters grew 66% and shelf-stable juices by 44%. While some food and beverage products are available beyond the dispensary channel, especially in e-commerce, significant growth beyond these channels awaits FDA approval of CBD as a legal food additive. BDSA even predicts its forecast that domestic CBD sales will reach $22 billion in 2026 on the assumption of approved additive status in 2022.

Education Equation

FDA approval isn’t the only hurdle CBD has to clear en route to realizing its potential; experts stress the importance of cognizant consumers, as well. In addition to all the other things brands need to do to launch a successful product, CBD brands must educate consumers so that they can make informed choices. This will prove especially important as sales spread beyond dispensaries—where consumers are already fairly savvy—into more mainstream venues.

It’s a tall order, but one that the sector—which seems to attract passionate advocates on both the buyer and seller sides—appears determined to meet. And for that reason and others, Baker is bullish on CBD’s future. “When people find a product that works for them, they stick with it,” he declares. “Products that solve problems stay relevant.”

Key Takeaways

The growing use of CBD is a telling indicator of consumer mindsets in 2022. In these tense times, consumers are in search of products that can facilitate their mental health goals. Even food & beverage brands that aren’t interested in including CBD in their portfolios can pursue these benefits through alternative products.

The all-purpose cannabis compound has carved out a place in millennials’ hearts, and its trajectory looks promising. Cannabidiol’s associated benefits of pain relief and anxiety reduction have driven its increased usage amid the pandemic, inflation, and these uncertain times. Food & beverage brands should consider the occasions for which consumers may be turning to CBD-infused products and whether these create opportunities or competitive threats for their own products.

Author: Nicole Brown

April 7, 2022 – 8 min read

CBD & The Post-COVID World

“It was the best of times, it was the worst of times…” The COVID-19 pandemic will be remembered as one of the darkest periods in our humanities history, but for cannabinoids, it may go down as its breakthrough moment, the ushering in of the golden age of CBD. Consumers made CBD a popular ingredient over the last two years as a potential remedy for the stress and anxiety induced by the COVID environment. COVID-19 has been a global game-changer on both the collective and individual level: daily routines, work environments, and health habits have been completely turned upside-down and transformed. The perpetual stress, immobility, and sense of uncertainty has taken a toll on consumers’ physical and mental well-being.

As a result of these challenges experienced, many consumers took their health and wellbeing into their own hands. There is both a new wave of consumers and a renewed interest of health-conscious consumers who are looking for transformative health products in the post-COVID environment. In the post-COVID world, there is an enormous opportunity for cannabinoids such as CBD to support consumer health, demonstrating again the power contained in this powerful botanical.

CBD During The Pandemic

The health benefit most associated with CBD is pain relief. But millennials — the generation credited with normalizing discourse about mental health — are especially attracted to CBD for its mental wellness benefits, including reducing anxiety, improving sleep, and offsetting symptoms of depression, which nearly half believe it can help with.

According to the recent State of Food and Beverage Report from Morning Consult, the pandemic has put mental health in the spotlight: 61 percent of millennials and 52 percent of U.S. adults said in January 2022 that “anxious” described their mood well, while a roughly equal share of U.S. adults said the same in January 2021. With Gen Z taking up the mantle in continuing mental health conversations, CBD (and likely THC) usage should continue to grow.

The growing use of CBD is a telling indicator of consumer mindsets in 2022. In these tense times, consumers are in search of products that can facilitate their mental health goals. Even food & beverage brands that aren’t interested in including CBD in their portfolios can pursue these benefits through alternative products.

Increased usage of CBD may also pave the way for THC-infused products in the food & beverage world, pending federal legality. Interest in THC products is just as high as it is for CBD products, and consumers are especially interested in food and beverage delivery methods. Further research and consumer education will help brands develop products containing CBD or THC targeted for specific uses, giving consumers more confidence in their safety and efficacy.

Passing the Stress Test

Of course, those projections may warrant recalculation should the stress levels that sent so many to CBD in the first place subside. But Dale Baker, President of The Valens Company, wagers we’re in no danger of experiencing any mass-relaxation event just yet.

“Are we really seeing lower stress levels?” he asks. “We all went through a time of unusual stress and uncertainty, and a non-intoxicating, plant-based tool for managing that stress was the right product at the right time. CBD sales are still strong emerging from the pandemic, and to speak from our perspective, we’ve not seen any dampening of demand.”

Cannabinoid market-research firm BDSA also acknowledges stress’s continuing influence on sales, noting that BDSA research shows 33% of CBD consumers cited anxiety management as their key consumption driver, while 32% cited stress management.

Sales Still Strong

The analysts at cannabinoid market-research firm BDSA have as granular a view as any on CBD’s momentum, and as far as they can tell, “CBD sales took a backseat to other essential purchases when the COVID-19 pandemic grew more urgent during the past year,” says Kelly Nielsen, BDSA’s vice president of insights and analytics. But even while in the backseat, domestic CBD sales grew 52% across channels in 2020, BDSA’s analysis reveals, with total sales tipping just over $4 billion for the year. The firm’s projections for 2021 estimate growth of 55%, as well, potentially raising the sector’s take to almost $6.3 billion.

As for where 2020’s sales occurred, the dispensary channel captured the lion’s share, by BDSA’s reckoning, and ultimately accounted for roughly 33% of the category total. But with 25% of the year’s CBD sales, e-commerce wasn’t far behind. In fact, BDSA predicts that if FDA regulations loosen, dispensary sales may shrink as mainstream distribution of CBD products grows. At the same time, though, e-commerce platforms look set to keep their sales on an upward path; BDSA even foresees the e-commerce channel adding $4.1 billion to the category’s till by 2026.

1 in 3 U.S. Adults, And Half Of Millennials, Have Tried A CBD Product

Before the pandemic, CBD went from a secret compound enjoyed by elites to a nearly unavoidable presence in retail stores across the country. Part of the chemical’s appeal lies in its universal applications: infused sparkling waters, chocolates, bath bombs, and, of course, gummies.

CBD’s ubiquity has led to an increase in awareness among U.S. adults, rising 5 percentage points since June 2019 to 65 percent. Usage, meanwhile, increased from around 1 in 4 to 1 in 3 over that same time period, with the share of respondents who have tried CBD products rising across every generation.

Perceptions of legality may play a role in the increasing usage: 73 percent of consumers now say CBD is legal, versus 61 percent in 2019. But a larger factor is likely the pandemic. This usage increase coincides with a period of heightened stress and anxiety stemming from both the pandemic and its economic toll. Amid the ongoing health crisis, consumers are looking for healthy methods to manage their physical, emotional, and mental well-being.

Evolving Need States

As the CBD category has diversified, so, too, has its typical shopper. And with that evolution, we’ve also seen an evolving set of need states among the consumer base.

For instance, while consumers who have been with the category for at least two years often gravitate toward products to “relax/be mellow” or “improve my quality of life,” those who have entered the market within the past month more often look for targeted benefits, like “relief of menopausal symptoms,” “post-workout recovery,” and “improved libido.”

This phenomenon emphasizes how new CBD consumers “like to shop by solution.” As one example, CBD product manufacturer Green Roads—which The Valens Company purchased in June 2021 — has a feature on its website recommending items “based on whether the consumer is trying to relax, sleep better, or keep their bodies moving for workouts or an active lifestyle,” Baker says.

All of which speak to the role that wellness plays in CBD’s success. Wellness products—topical creams, balms, salves, etc.—as well as pharmaceuticals and supplements, will be the three biggest categories driving CBD sales in the coming years, and wellness alone is expected to contribute $2.9 billion to the growth of the U.S. CBD sales by 2026.

Health-and-wellness consumers are looking for functional ingredients in all their lifestyle purchases, and the data show that consumers are willing to take advantage of CBD’s benefits in everyday products, rather than in standard medicinal products.

Food for Thought

Also driving sales are edible applications. BDSA ranks edibles the most popular CBD delivery format, with 75% of consumers who’ve partaken of the cannabinoid in the past six months reporting to have chosen an edible. IRI data also indicated growth of more than 23% in the food channel.

SPINS data paint a similar picture, with CBD-infused beverages looking especially bright. Shelf-stable coffee sales were up 111% through June 13, while shelf-stable waters grew 66% and shelf-stable juices by 44%. While some food and beverage products are available beyond the dispensary channel, especially in e-commerce, significant growth beyond these channels awaits FDA approval of CBD as a legal food additive. BDSA even predicts its forecast that domestic CBD sales will reach $22 billion in 2026 on the assumption of approved additive status in 2022.

Education Equation

FDA approval isn’t the only hurdle CBD has to clear en route to realizing its potential; experts stress the importance of cognizant consumers, as well. In addition to all the other things brands need to do to launch a successful product, CBD brands must educate consumers so that they can make informed choices. This will prove especially important as sales spread beyond dispensaries—where consumers are already fairly savvy—into more mainstream venues.

It’s a tall order, but one that the sector—which seems to attract passionate advocates on both the buyer and seller sides—appears determined to meet. And for that reason and others, Baker is bullish on CBD’s future. “When people find a product that works for them, they stick with it,” he declares. “Products that solve problems stay relevant.”

Key Takeaways

The growing use of CBD is a telling indicator of consumer mindsets in 2022. In these tense times, consumers are in search of products that can facilitate their mental health goals. Even food & beverage brands that aren’t interested in including CBD in their portfolios can pursue these benefits through alternative products.

The all-purpose cannabis compound has carved out a place in millennials’ hearts, and its trajectory looks promising. Cannabidiol’s associated benefits of pain relief and anxiety reduction have driven its increased usage amid the pandemic, inflation, and these uncertain times. Food & beverage brands should consider the occasions for which consumers may be turning to CBD-infused products and whether these create opportunities or competitive threats for their own products.