Author: Dave Neundorfer, CEO

At OBX, we often ask ourselves, what does the start of a new pattern look like?

It’s a highly relevant question in any industry, but especially critical in the cannabinoid industry where discovery, research, development, and consumer trends move at lightning speed.

Our answer: the start of a new pattern is an outlier. But what do you do with it?

In his 2007 bestseller, Blink, Malcolm Gladwell coined the term thin-slicing–“the ability of our unconscious to find patterns in situations and behavior based on very narrow slices of experience.”

In other words, trust your gut.

Thin-slicing is one of the most important organizational muscles for CBD companies seeking to stay ahead of the curve. It’s a muscle that we recently flexed.

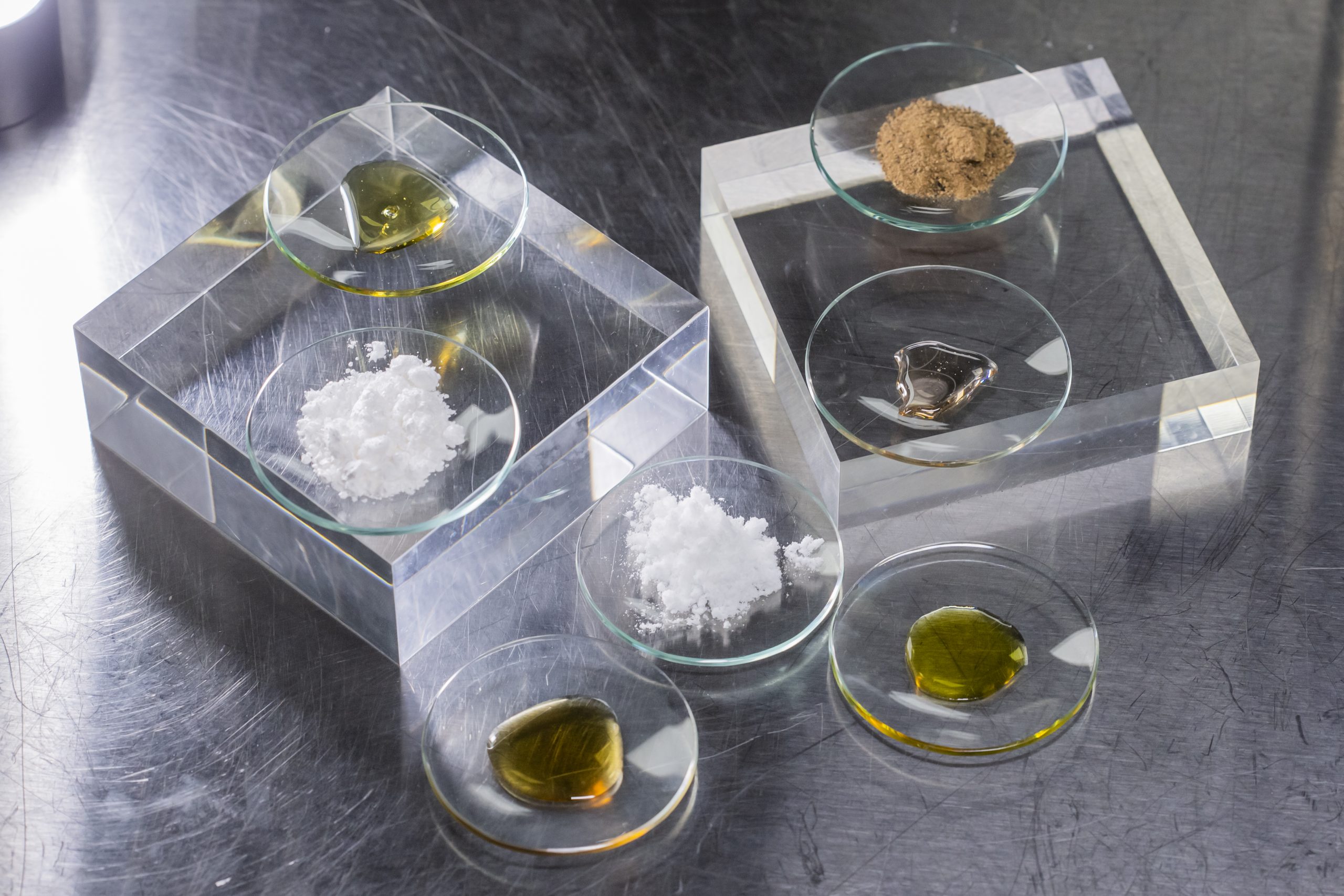

About a month ago, we received an RFP for a kilogram of distillate with a unique cannabinoid profile–an outlier–for which we needed isolated minor cannabinoids to fulfill. A week later we received an RFP for a second bespoke cannabinoid profile. Both RFPs were from well known brands making their initial foray into CBD (our target market). By the time we received the third in under three weeks, we were finalizing an acquisition of a leading minor cannabinoid development and production company.

Next week we will be revealing our acquisition target and how, together, we will bring a new pattern into focus as we pave the way to CBD 3.0.

The old pattern–where brokers and buyers spec bought from whomever was willing to provide the lowest price–will soon fade away.

Gone are the days where brands are willing to accept the cannabinoid inconsistencies from one run to the next. The buyers of tomorrow demand consistent, high quality, formulation-ready profiles so they have a precisely controlled input to optimize R&D, formulation, and consumer experience.

Gone are the days where brands pretend that cannabidiol does everything. While it naturally occurs in the highest concentrations and is also the easiest of the cannabinoids to extract, it is by no means the most medically or commercially interesting. Going forward, it will play a harmonizing role in product formulations, not a solo act. We will conduct the research needed to develop function-focused profiles so we can deliver the formulations that specifically address the consumer’s desired outcome.

This evolution will help the industry mature beyond CBD 2.0, which focused on the ingredient for the ingredient’s sake–it’s CBD, what more do you need to know?

This will also unlock the market growth that stalled as a result of cannabidiol price compression and COVID-induced slowdown.

Remember when every CBD pitch deck included some well-known analytical research group’s prediction that the CBD market size will be $25B by 2025? This hot take drove the giants of CBD 2.0 to build out the infrastructure to serve global demand ten times over. Unfortunately, it’s 2020, the single-cannabinoid industry plateaued at ~$1.5B, and those giants are going out of business.

I still believe the CBD market will reach $25B by 2020, but by expanding “CBD” to cannabinoids, not just cannabidiol.

Here’s how we get there.

- First, we will have the ability to create bespoke cannabinoid profiles, providing the quality and consistency needed for R&D, formulating, and delivering safety and reliability to end consumers that will attract food, beverage, nutraceutical, and, eventually, pharmaceutical buyers to this market.

- Second, we will conduct the research needed to provide scientific support and validation needed to develop function-specific formulations targeting anxiety, insomnia, and inflammation, and, in the future, obesity, acne, and lethargy.

- Third, we will educate the market to advance beyond the magic ingredient phenomenon, and will join forces in this effort with groups like Trait Biosciences, who worked with Visual Capitalist on a great infographic on the power of minor cannabinoids.

Of course, to make form-function claims, significant investments must be made in safety and efficacy research to help guide consumers, retailers, brands and regulators. We are preparing to be well positioned to lead this effort and accelerate the path to research, regulation, banking, and big-name brands that will define CBD 3.0.

Stay tuned for our exciting announcement next week to learn more.

Author: Dave Neundorfer, CEO

At OBX, we often ask ourselves, what does the start of a new pattern look like?

It’s a highly relevant question in any industry, but especially critical in the cannabinoid industry where discovery, research, development, and consumer trends move at lightning speed.

Our answer: the start of a new pattern is an outlier. But what do you do with it?

In his 2007 bestseller, Blink, Malcolm Gladwell coined the term thin-slicing–“the ability of our unconscious to find patterns in situations and behavior based on very narrow slices of experience.”

In other words, trust your gut.

Thin-slicing is one of the most important organizational muscles for CBD companies seeking to stay ahead of the curve. It’s a muscle that we recently flexed.

About a month ago, we received an RFP for a kilogram of distillate with a unique cannabinoid profile–an outlier–for which we needed isolated minor cannabinoids to fulfill. A week later we received an RFP for a second bespoke cannabinoid profile. Both RFPs were from well known brands making their initial foray into CBD (our target market). By the time we received the third in under three weeks, we were finalizing an acquisition of a leading minor cannabinoid development and production company.

Next week we will be revealing our acquisition target and how, together, we will bring a new pattern into focus as we pave the way to CBD 3.0.

The old pattern–where brokers and buyers spec bought from whomever was willing to provide the lowest price–will soon fade away.

Gone are the days where brands are willing to accept the cannabinoid inconsistencies from one run to the next. The buyers of tomorrow demand consistent, high quality, formulation-ready profiles so they have a precisely controlled input to optimize R&D, formulation, and consumer experience.

Gone are the days where brands pretend that cannabidiol does everything. While it naturally occurs in the highest concentrations and is also the easiest of the cannabinoids to extract, it is by no means the most medically or commercially interesting. Going forward, it will play a harmonizing role in product formulations, not a solo act. We will conduct the research needed to develop function-focused profiles so we can deliver the formulations that specifically address the consumer’s desired outcome.

This evolution will help the industry mature beyond CBD 2.0, which focused on the ingredient for the ingredient’s sake–it’s CBD, what more do you need to know?

This will also unlock the market growth that stalled as a result of cannabidiol price compression and COVID-induced slowdown.

Remember when every CBD pitch deck included some well-known analytical research group’s prediction that the CBD market size will be $25B by 2025? This hot take drove the giants of CBD 2.0 to build out the infrastructure to serve global demand ten times over. Unfortunately, it’s 2020, the single-cannabinoid industry plateaued at ~$1.5B, and those giants are going out of business.

I still believe the CBD market will reach $25B by 2020, but by expanding “CBD” to cannabinoids, not just cannabidiol.

Here’s how we get there.

- First, we will have the ability to create bespoke cannabinoid profiles, providing the quality and consistency needed for R&D, formulating, and delivering safety and reliability to end consumers that will attract food, beverage, nutraceutical, and, eventually, pharmaceutical buyers to this market.

- Second, we will conduct the research needed to provide scientific support and validation needed to develop function-specific formulations targeting anxiety, insomnia, and inflammation, and, in the future, obesity, acne, and lethargy.

- Third, we will educate the market to advance beyond the magic ingredient phenomenon, and will join forces in this effort with groups like Trait Biosciences, who worked with Visual Capitalist on a great infographic on the power of minor cannabinoids.

Of course, to make form-function claims, significant investments must be made in safety and efficacy research to help guide consumers, retailers, brands and regulators. We are preparing to be well positioned to lead this effort and accelerate the path to research, regulation, banking, and big-name brands that will define CBD 3.0.

…while continuing to look for outliers, bring new patterns into focus, while flexing our thin-slicing muscles.

Stay tuned for our exciting announcement next week to learn more.